This article is the second in a series seeking to inform how the regulatory environment is shaping the plastics industry. In this article, we illustrate how packaging material and design choices can affect compliance costs under impending EPR schemes.

The regulatory environment is heating up for plastics.

Jurisdictions across the globe continue to push ahead with Extended Producer Responsibility (EPR) schemes to address the growing plastic pollution crisis driven in large part by packaging. In March 2024, the EU came a step closer to adopting its new Packaging and Packaging Waste Regulation (PPWR); in the US, a Senate hearing on packaging EPR pointed to the need for a federal role to ensure consistency and reduce complexity across state EPR schemes; and even the private financial sector called for an international legally binding instrument, mandating EPR, to end plastic pollution. Companies must urgently prepare for the new legislation.

EPR fees alone could double the cost of virgin plastic materials.

While EPR scheme structures and fees have yet to be determined in the US states, looking at the evolution of EPR in Europe suggests that eco-modulation will become the dominant system. Under eco-modulation, total EPR fees are determined not only on the basis of the quantity and weight of plastic, but also as a function of recyclability, recycling rates, reusability, hazardous substances, and recycled content. Weight-based EPR fees can vary from $300 to $1,400 per tonne (depending on the plastic material), versus spot prices for virgin plastics between $700 and $1,200 per tonne, thus representing between roughly 50% and 100% of the cost of the virgin material. The use of PCR, on the other hand, may generate a “bonus” under EPR schemes, thus making PCR even more attractive relative to virgin plastics. We believe this is a tipping point for reducing overall green premiums and catalyzing PCR adoption. It should be noted that businesses are likely to see compliance costs increase further, not only as a result of EPR fees, but also due to import tariffs and carbon pricing affecting material markets including plastics.

Figure 1: EPR eco-modulation effectively removes green premium associated with PCR Plastics

Packaging material and design choices matter.

An illustrative simulation of EPR fees applied to a brand owner’s packaging portfolio reveals how a rationalized portfolio can nearly halve EPR fees. The example is fueled by real data and actions taken by brand owners who are signatories of the Global Commitment. Under the EPR fee structure in France (determined by the Producer Responsibility Organization (PRO) Citeo), for a 100,000 metric tonne plastic packaging portfolio, the example illustrates that under a “business-as-usual” scenario (primarily virgin plastic) EPR fees can amount to nearly $50 million (while material costs amount to approximately $100 million). Meanwhile, a rationalized portfolio (less plastic overall with higher percentage of recycled plastic) results in a 45% reduction in EPR fees (totaling $26 million) and 10% reduction in material costs (totaling $91 million).

Figure 2: Packaging choices can deliver significant impact

Moving to PCR now can literally save millions of dollars in fully loaded material costs.

Brand owners are making significant commitments to use post-consumer recycled (PCR) content in their packaging. Starbucks recently published a 2030 target to source consumer-facing packaging from 50% recycled materials, while Global Commitment business signatories collectively commit to reaching 26% share of PCR content by 2025. In our illustrative example, the “bonus” from using 25% PCR content amounts to nearly $10 million.

Figure 3: Breakdown of EPR fees for rationalized vs. BAU packaging portfolios

Changes can be made rapidly to the portfolio, but require commitment and advanced planning.

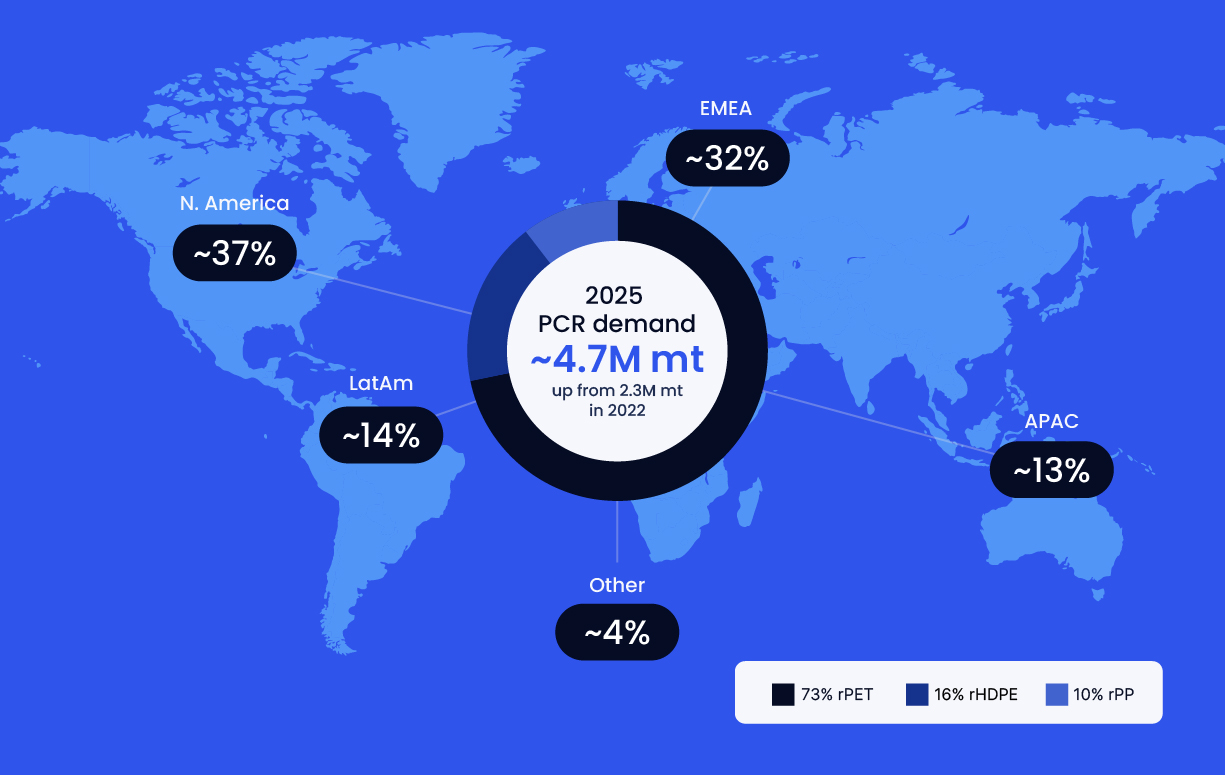

Top quartile Global Commitment (GC) brands and retail signatories have increased their share of recycled content by over 19% between 2018 and 2022. While U.S. states move ahead on the specifics of their EPR schemes, producers can prepare for implementation by rationalizing their portfolio: eliminating virgin plastic (e.g., eliminating components, lightweighting to a certain extent), substituting hard-to-recycle plastics (e.g., multilayer material, PVC, polystyrene), using PCR content in packaging. Among packaging producers and user GC signatories, we estimate that PCR demand will double by weight between 2022 and 2025, from 2.3 million to 4.7 million metric tonnes globally, significantly outpacing demand for virgin plastic. Over one-third of that demand is expected to be in North America.

Figure 4: Inferred 2025 PCR demand from Global Commitment packaging producer and user signatories

With so much value at stake, there is no time to lose.

Circular is here to help secure reliable PCR supply at speed and scale. Last quarter, Circular helped source 35,000 tons of PCR across multiple uses and industries, with capacity for orders of magnitude more. With a global network of over 9,000 suppliers and data from over 50,000 technical data sheets, Circular helps brands find the PCR they need to replace virgin plastic at digital speed.

Visit circular.co to learn more and book a demo.

Subscribe and stay up to date with

the latest industry insights and news.

Sources:

FIgure 1: CITEO; Argus; Platts; Circular analysis (CITEO EPR fees applied)

Figure 2: EMF Global Commitment; CITEO; Argus; Platts; Circular analysis (French PRO CITEO EPR fees applied to entire plastic packaging portfolio)

Figure 3: EMF Global Commitment; CITEO; Argus; Platts; Circular analysis (CITEO EPR fees applied)

Figure 4: EMF Global Commitment 2023 Report (does not include EMF GC Signatories that have not specified 2022 packaging weight); Circular team analysis